Have you ever seen a video of your favorite celebrity saying something outrageous? Then later, you find out it was completely fabricated? Or perhaps you’ve received an urgent email seemingly…

Have you ever seen a video of your favorite celebrity saying something outrageous? Then later, you find out it was completely fabricated? Or perhaps you’ve received an urgent email seemingly…

Ahoy wise captain! As ye sail the cyber seas, beware of hazardous waters teaming with ruthless buccaneers thirsty for plunder, sharks, and shoals. But with proper cybersecurity preparations and a…

If you steer the ship of a modern organization, you face harsh truths that lurk just beneath the waves – cybersecurity threats multiply exponentially as data pirates deploy increasingly sophisticated…

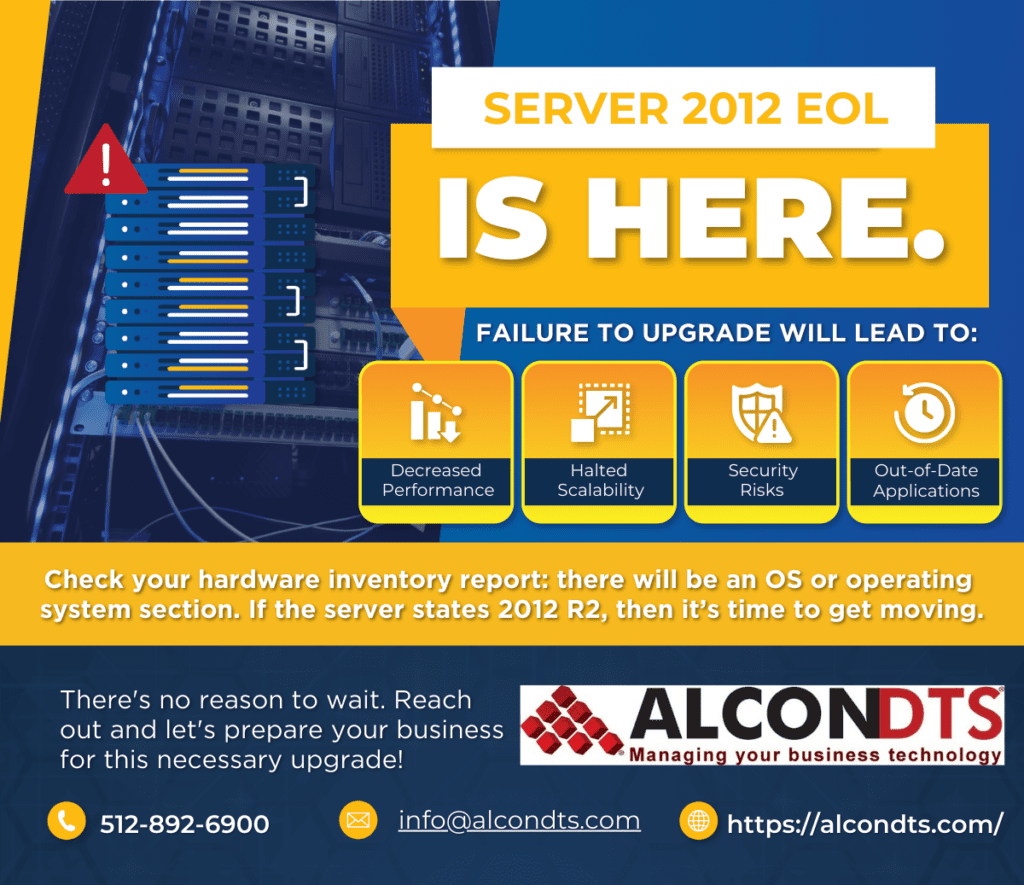

For businesses with on-premises servers that weren’t purchased and configured in the last few years, this announcement means change is here. We’re here to help minimize disruptions that will come…

You must be logged in to post a comment.